What is a DePIN, and why is it important?

Hello, everyone, and welcome to all newly joined subscribers!

Over the last year, dozens of media outlets, including big names like Bloomberg, Forbes, and The Wall Street Journal, have explored the benefits of converging Web3 and artificial intelligence. They all highlight blockchain as a potential security, data authenticity, and privacy layer of AI, and a tool for keeping it transparent, censorship resistant, and reliable. I agree with them, but I fear these pieces often sound like a gibberish to the wide public and fail to convince of that fascinating synergy's true value. So, with all of you in mind, I am launching a series of deeper and more comprehensive analyses of particular Web3 + AI use cases, their implementations, advantages over the legacy system, and prominent actors. Starting off with the burgeoning DePIN sector.

Thank you for being here! Let's dive in!

What is a DePIN?

DePIN is the abbreviation for decentralized physical infrastructure networks. The term is used to indicate an emerging and quickly growing category of blockchain projects that aim to decentralize different types of infrastructure utilities like power, Internet, or telecommunications, and, thus, make them community-owned. Both the decentralization and the collective ownership of DePINs are powered and incentivized through blockchains and their associated cryptocurrencies.

To make it clearer, let's break DePINs' key components down:

- Distributed hardware resources: A DePIN project hosts a network, as large and highly distributed as possible, of members who voluntarily offer their idle hardware resources to power the DePIN's objectives. The type of hardware can spread across free disk space, servers, Internet routers, or renewable energy generators, to name just a few. People frequently deliver resources that may otherwise remain unused, so it is a win-win set-up for everyone.

- Permissionlessness: Following the crypto industry's ethos, DePINs are permissionless, meaning anyone is welcome to contribute, as long as they have the right hardware.

- One common goal: Per the kind of hardware employed, the DePIN participants can power a broad range of technologies. They can contribute idle computation capacity to the training of AI models, sensors to the collecting of environmental data, or cameras to the navigation of autonomous vehicles. Thus, DePINs are capable of disrupting a bunch of industries, including the ones dominated or even monopolized by large corporations like telecoms or electric utilities.

- A middleware layer: DePIN participants have to be able to coordinate to provide resources where and when they are mostly needed. That is why an efficient and battle-tested Peer-to-Peer communication network is paramount. The middleware layer acts as “the connectivity fabric enabling seamless interaction between the decentralized digital realm of blockchains and existing physical-world infrastructure”.

- A blockchain layer: Each DePIN project gets built on top of a blockchain, whether that is a Layer1 or a Layer2 one. According to Messari, Solana is the preferred chain for DePINs, although DePIN-specific blockchains like IoTeX and Peaq Network have started to emerge. The blockchain layer is essential, since the incentivization of members for the physical resources they make available is a fundamental part of a DePIN. And because rewards are paid in crypto, blockchain plays the role of a global and universal payment settlement layer. Accordingly, the tokenomics (the economic model of a given cryptocurrency or token) of each particular DePIN project is tuned to stimulate either the supply or the demand side, as per the project's objectives and needs.

All of these components have to coexist for a project to be defined as a DePIN. Incentivizing the community with crypto, for instance, is not a new practice, rather it has been used since the dawn of the industry to boost community growth or enhance decentralization. But here, it is employed to encourage participants to lend their unused general-purpose hardware, and thus fuel a real decentralized sharing economy - think Uber without the Uber on top.

Why do we need DePINs?

The term DePIN has become one of the most recognizable buzzwords in the world of crypto, as new DePIN projects appear daily. Analysts and experts started paying attention to the sector, including Messari publishing a detailed investigation into the State of DePIN and IoTeX launching the real-time DePIN data explorer DePINscan.

There is already a DePIN newsletter and at least one DePIN-dedicated podcast. Many people even regard the DePIN sector as one of the biggest engines behind the current crypto bull run.

But where did all that excitement come from, you would ask? Well, to paraphrase the famous expression, all roads lead to the good old AI. Crypto companies have been experimenting with DePIN use cases for years, but the recent AI boom is what boosted DePINs proliferation and significance.

As Ilya Sutskever says, to achieve anything in AI, you need loads and loads of computational capacity. That prerequisite is so fundamental that, except for regulatory hurdles or a lack of data, there is nothing else capable of hindering or stopping the progress of artificial intelligence. Before the 2023 AI summer, companies rarely invested in acquiring computing power, but rather rented as much as required via the dominant cloud services providers: Google, Microsoft, and Amazon. However, with all the hype, profitable opportunities, and, of course, competition that the launch of ChatGPT unleashed, it turned out that the only way to grow in the generative AI business passes through owning graphic processing units (GPUs).

Naturally, as GPUs became the hottest commodity in existence, the demand far outpaced the supply. Meanwhile, the shortage was exacerbated by the fact that there is one producer, namely Nvidia, whose GPUs are perceived as far superior to rival products for AI work. To illustrate the gravity of the situation, let me just say that Nvidia is now so powerful that the economic prosperity of whole nations is in its hands alone. It is no wonder that OpenAI's Sam Altman recently took on a quest to rival Nvidia's supremacy by building a global network of chip manufacturing facilities:

Fortunately, here comes blockchain to solve the stalemate and offer one of the most logical and straightforward Web3 + AI use cases. The last few months have shown that AI researchers and entrepreneurs have no alternative way of fighting the GPU dearth than by relying on DePINs' resources. At the same time, the supply side seems to be expanding as well, since new DePIN operations begin daily and even former cryptocurrency miners started switching and renting out their GPUs.

Moreover, it quickly becomes evident that decentralized computation providers offer the bonus of lower prices as compared to legacy cloud services. The fact that DePINs take advantage of members' existing hardware, do not need to acquire resources, nor are they responsible for the hardware maintenance cost, makes them to a large extent more capital-efficient than incumbents. It seems like well-incentivized distributed communities can outstrip the economies of scale of a corporation.

The Ultimate DePIN Classification

It may seem now like computation and cloud services are the only industries disrupted by DePINs, but as I said above, that is not the case. The physical hardware a DePIN delivers may vary, so sectors like file storage, ride-sharing, and geospatial navigation also currently experience a transformation.

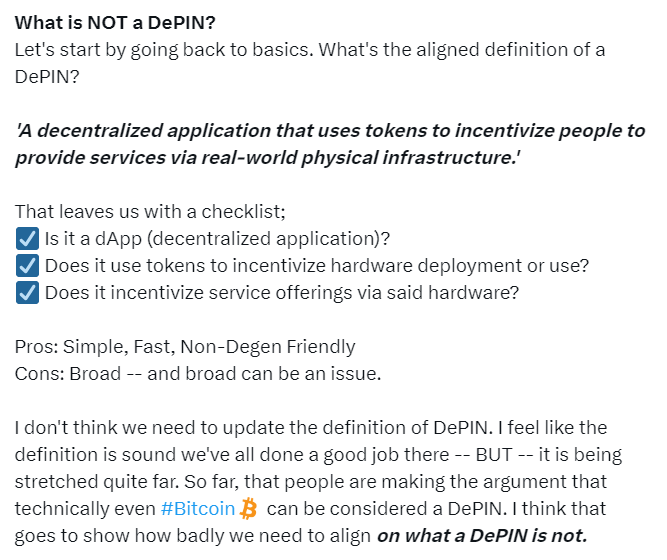

The question of determining which project is a DePIN has been on the crypto agenda for some time, as people have different opinions on it. Besides, as with every other hype cycle, there are always protocols attempting to feed on the excitement and rebrand, even if their business model has nothing to do with the criteria I outlined in the beginning.

For instance, the investor Mahesh Ramakrishnan puts human resources and talent acquisition networks in the DePIN category, citing Braintrust and its peer-to-peer mentoring products as an example. I found that excessive. After all, the physical hardware component i.e. a machine is what makes up a DePIN. On the other hand, IoTeX's co-founder Raullen Chai groups DePINs into providers of physical resources, such as sensors, wireless, mobility, and digital resources, where he puts compute, storage, and decentralized AI assistants. That classification doesn't make much sense to me, since digital resources like computing power and data storage also depend on the underlying physical infrastructure.

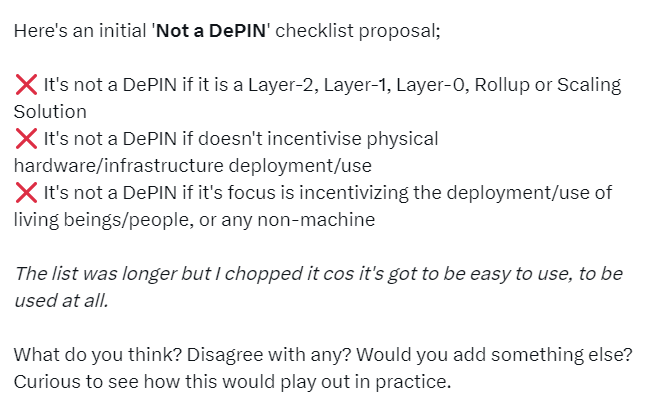

Chai also classifies the AI Agents network Fetch.ai as a DePIN, which I wouldn't do. The only community-owned physical resources that take part in Fetch.ai's operations go toward securing and validating their blockchain, but the same goes for every other PoS blockchain. And as Peaq Network's Max Thake commented, if it is a chain itself, it is not a DePIN:

However, the above-mentioned Messari report also cites Fetch.ai along with other AI-focused projects like Autonolas / Olas and Bittensor. But while Fetch.ai's AI agents framework does not require the use of any personal HW resources, Autonolas / Olas, a dApp built by Valory, actually incentivizes people to run agents, supposedly using their machines.

The other categories Messari outlines are as follows:

- compute (servers, CPUs, GPUs, storage, etc.)

- wireless (mobile, fixed Internet, WiFi)

- sensors (noise, temperature, pollution, etc.)

- energy

- services

I also find the nature of the used hardware to be the most logical and straightforward distinguisher, so I generally agree with that classification. Though, the big exception for me is the service marketplaces. A service category, in which, again, HR marketplaces are featured, along with ad networks, should not appear in a DePIN classification at all. What is more, Messari puts data and file storage projects like Arweave and Filecoin in the compute class, whereas I believe they deserve an entirely separate category.

Stay tuned for future articles exploring each separate class, with primary focus on the ones capable of impacting the AI research and development.

“Think of it: AI enables machines to function as independent economic agents creating real-world value, and the DePIN model creates an ownership and value distribution framework for that, enabling owners of AI-powered devices to earn from their activities.” Leonard Dorlöchter, the co-founder of the Peaq Network

Conclusion

The crypto space can no longer be blamed for coming up with solutions in search of a problem. This time, blockchain technology resolves a pressing and urgent issue while also providing the most capital- and resource-efficient solution in existence. There is no doubt DePINs will lead this crypto bull run, especially since, as Coin Bureau commented, projects that are non-financial in nature will dominate as they are less prone to attract regulatory scrutiny.

The DePIN sector is expected to reach a market cap of $3.5 trillion over the next 4 years. It is able to address many of the ICT (information and communication technology) constraints the world faces nowadays, as well as fix both the data and the compute limits to scaling AI. It offers levels of robustness, adaptability, and resilience the legacy system simply cannot match. And most of all, it brings decentralization, democratization, and community ownership to traditionally corporate-controlled industries.

Disclaimer: None of this should or could be considered financial advice. You should not take my words for granted, rather, do your own research (DYOR) and share your thoughts to create a fruitful discussion.